Sample Tax Report

ShareCalc delivers comprehensive tax reports for UK investors, providing all the information you need to complete your tax return with confidence. Access your reports through our interactive web interface or download a PDF for your records.

- View and filter reports by tax year and asset lifetime, giving you complete flexibility

- Each report includes both a summary view and detailed breakdowns of all income and capital gains events, ensuring nothing is missed

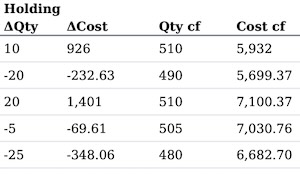

- See your current portfolio with up-to-date cost basis, quantity, and non-resident quantity information

- Easily drill down into specific transactions with our detailed view of each tax event

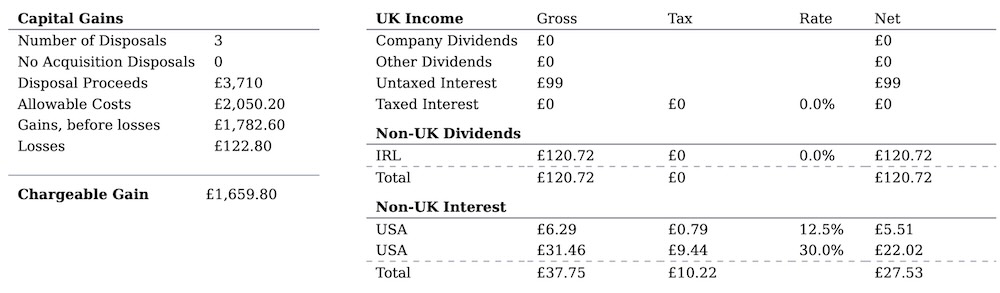

Report Summary

Every report contains a complete summary of your tax position presented with the information required to complete your tax return, making filing your tax return straightforward and accurate.

- Income broken down by country using HMRC's codes and by withholding tax rate

- Full support for multiple tax rates in the 2024-2025 tax year

- Overview of your tax position both in aggregate and broken down by individual asset

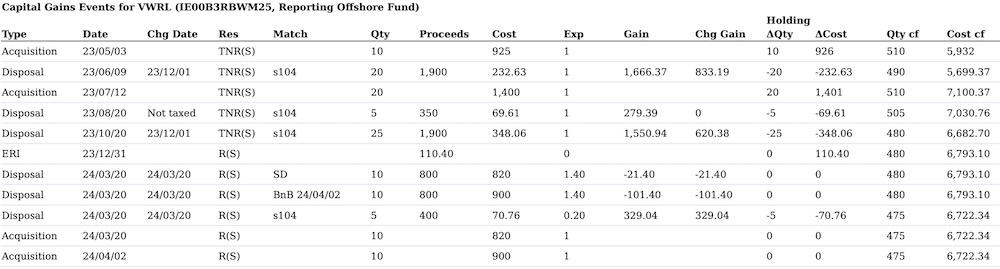

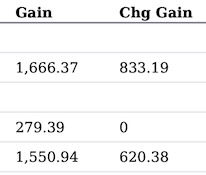

Capital Gains Events

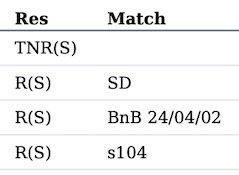

The capital gains section provides a complete, audit-ready breakdown of all events affecting your section 104 holdings and capital gains tax.

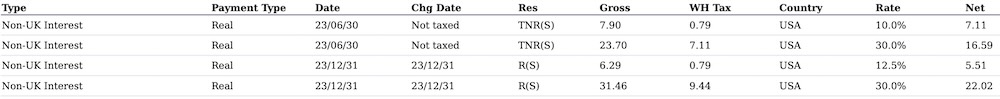

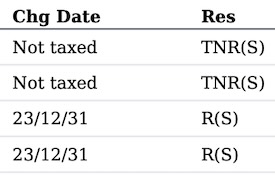

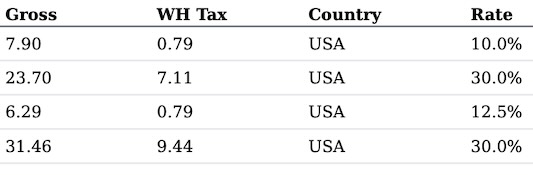

Income Events

The income section contains a full, verifiable breakdown of all income events, their taxable status, and any tax already withheld.

Residency status on the date of event and taxable status and date

Full overview of gross income and withholding tax

Start tracking your investments today and take the stress out of tax season. Generate comprehensive tax reports with just a few clicks.