ShareCalc Features

ShareCalc simplifies UK investment tax management with an end-to-end solution that transforms your tax experience. From seamless broker statement imports to generating audit-ready tax reports, we handle all the complexities so you can focus on investing.

- Suitable for individuals subject to income tax

- Full support for transactions from 1998

- Supports Stocks, Currencies, Offshore reporting funds, and UK funds

- Seamlessly handles trades, dividends, interest, equalisation, excess reportable income (ERI), capital distributions, share reorganisations, and more

In-Depth Tax Reporting

Get crystal-clear insights into your tax position with our comprehensive reporting system. From high-level summaries to transaction-level details, everything you need is at your fingertips.

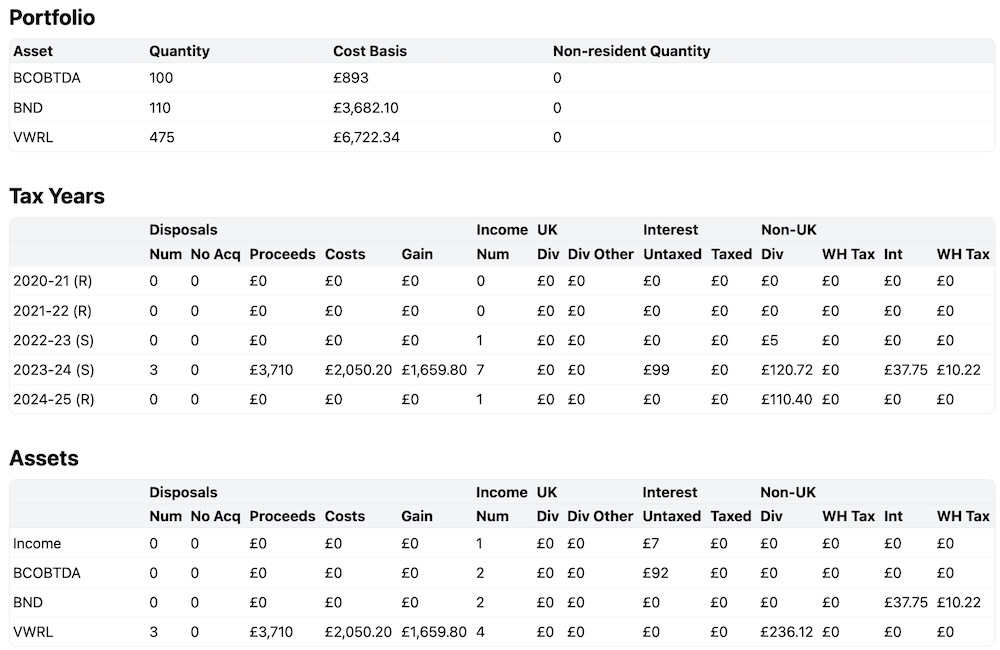

Portfolio & Tax Overview

View your existing portfolio and an overview of all your tax years and assets in the tax section

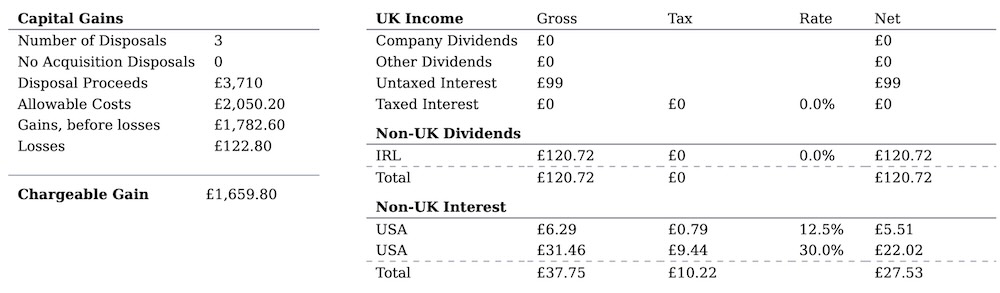

Tax Year Summary

Understand your tax position at a glance with the summary section and its HMRC ready breakdown

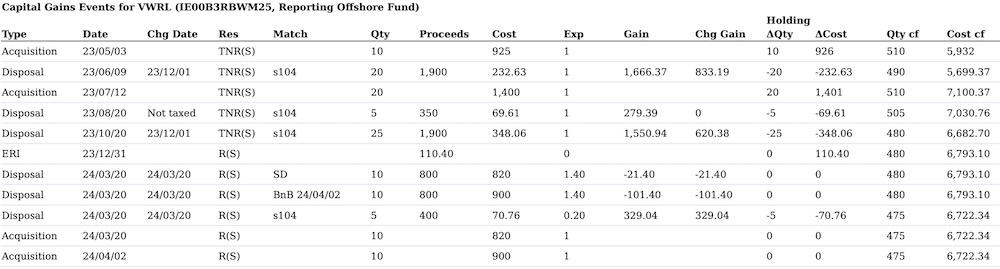

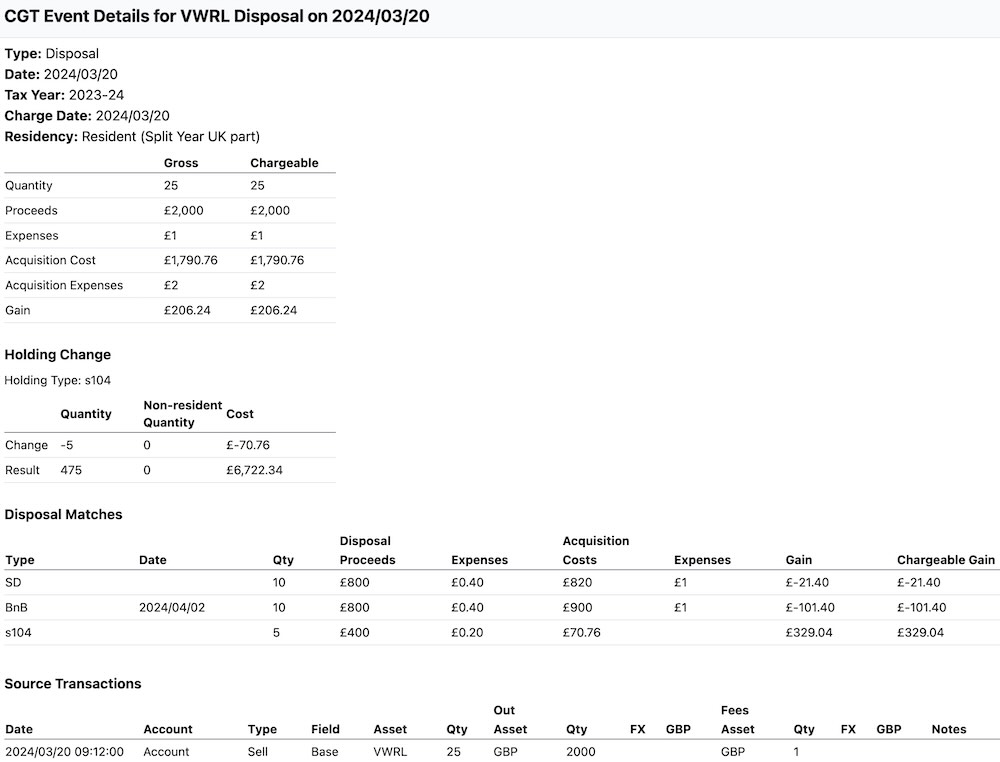

Capital Gains Tax Reporting

The CGT section provides a complete, audit-ready list of all events affecting your section 104 holdings and capital gains tax

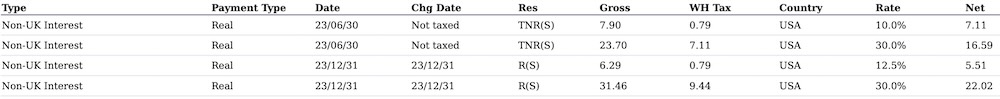

Income Reporting

The income section gives you all the details of your income events, including taxable status and any tax withheld

Detailed Event Analysis

See the full details of every taxable event including all matched transactions and source transactions

Seamless Data Import

Eliminate tedious manual data entry with our intelligent import system. Just upload your broker statements from Interactive Brokers, Halifax, or our custom CSV format, and ShareCalc automatically processes your investment data with precision.

- Support for Interactive Brokers, Halifax, and our custom CSV format

- Manually add and edit transactions using our web interface

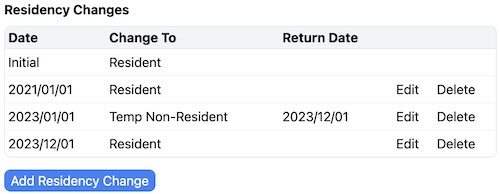

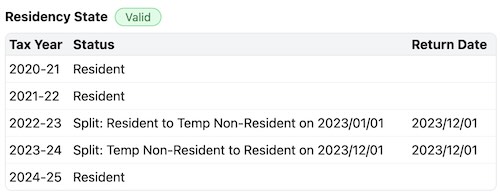

Residency Support

Navigate the complexities of UK tax residency with confidence. Whether you're a full UK resident, experiencing split tax years, or temporarily non-resident, ShareCalc precisely applies the correct tax rules to each period—simply input your status changes and let us handle the calculations.

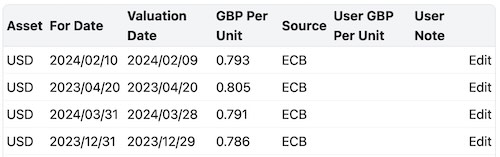

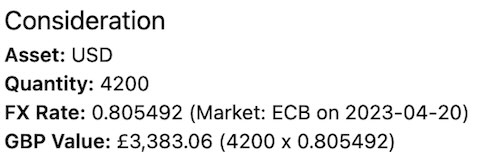

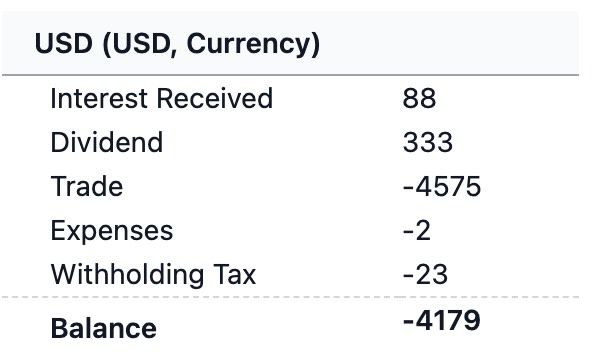

Automatic Currency Conversion

Meet HMRC requirements effortlessly with automatic currency conversion. ShareCalc converts all transactions to GBP using ECB historical exchange rates for the exact transaction date, ensuring compliance while saving you hours of manual calculations.

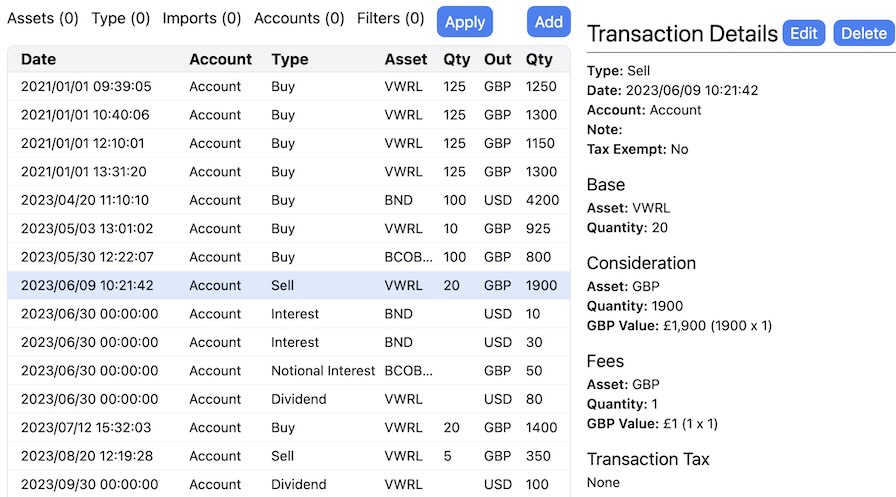

Transaction Management

View and edit all the transactions in the system. See the tax impact of every transaction.

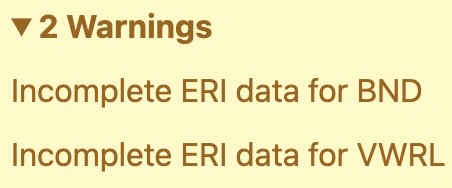

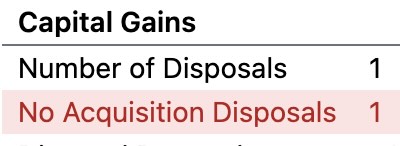

Integrity Checks

Trust your tax calculations with ShareCalc's comprehensive integrity safeguards. Our system checks your data for inconsistencies, flags potential issues before they become problems, and prevents report generation when critical errors are detected—giving you confidence in your tax submissions.

Private and Secure

Your financial data's security is our priority. ShareCalc implements industry-standard security practices including:

- Secure HTTPS encryption for all data transmission

- Cloud hosting with enterprise-grade security protocols

- Regular security updates and monitoring

- Strict data access controls

- We only collect the information necessary to provide our service

Start tracking your investments today and take the stress out of tax season. Generate comprehensive tax reports with just a few clicks.